A payroll system is a system that helps a company to manage things related to payrolls such as basic pay, deductions, compensation, and benefits. Companies should not make mistakes in paying their employees because it might affect employees’ perception of the company. If a company still does payroll manually, it might have a higher risk of error calculation. That’s why companies need to upgrade payroll system to help them calculate and manage employees’ payroll.

An upgrade to the payroll system can save time because the payroll system tends to automate the whole payroll process. In addition, using a payroll system means you can focus more on some strategic planning. The HR department can figure out new ideas to keep employees work at their best.

Because payroll is one of the most important aspects of business, it can affect employee morale. Also, it can reflect business stability and reputation. Employees rely on their paycheck so if there are any errors or late payment it can create a lack of trust. When their paychecks are accurate and delivered on time, employees tend to more engaged and motivated in their work.

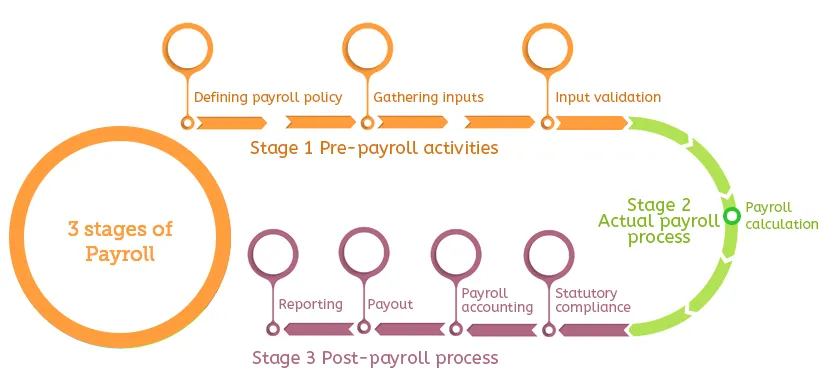

There are 3 stages in the payroll process, pre-payroll, actual payroll, and post payroll activities.

1. Pre-payroll Activities

a. Defining policy

The first-ever step of pre-payroll activities is to create company policies regarding payroll, such as pay policy, leave policy, benefits policy, and attendance policy. After all those policies are made, make sure to get the approval of the company’s management.

b. Gathering input data

Payroll is not a stand-alone process. There are multiple departments involved such as the HR department and the Finance department. Sometimes, there are mid-year salary revisions and additional data about an employee’s attendance data that need to be inputted into the payroll process. For a small company, this process might be not too complex, but for a larger company, gathering this kind of data can be very complex. This is where payroll software help. A lot of payroll software can help integrate leave and attendance management.

c. Input validation

The last process in the pre-payroll process is to check the validity of data and whether the data are adhering to company policies. In this process, it is important to make sure that all active employees are not missed.

2. Actual Payroll Process

a. Payroll calculation

In this process, the input data is put into the payroll system to actually calculate employees’ net pay after deductions such as taxes. Also, the payroll system will help companies to generate payslips for employees. It is important to verify payslips’ accuracy to avoid errors that might happen.

3. Post-Payroll Process

a. Statutory compliance

After calculating employees’ statutory deductions such as CPF and tax, the HR staff who is in charge of payroll need to send the amount to the government agencies. Most of the deductions can be made through specific forms. Don’t forget to fill the forms based on the actual data.

b. Payroll accounting

The company needs to keep a record of all the payroll processes regarding financial transactions. Salaries are included in the operating costs and should be recorded in the book of accounts. Payroll management should always ensure that all salary, reimbursement, even deductions are accurately recorded into the company’s accounting.

c. Payout

Employees’ salaries can be paid out by cash, GIRO, check, or even bank transfer. Typically, the company will deposit salaries directly to an employee’s bank account. Some payroll software has an employee self-serve portal, so it will be easier to publish payslips and employees can log in to their account to see their payslip.

d. Reporting

After the whole payroll process is done for a month, the finance department might ask for a report regarding payroll. HR staff that manages payroll will need to gather the data and create a report to give to the finance department.

When is the right time to upgrade payroll system?

Payroll is an integral part of a company’s operations. Not only is it responsible for employees’ salary compensation but it also plays an important role in protecting a company by ensuring it is following compliance with government regulations in Singapore.

Manual payroll calculation is prone to human errors. That is what the payroll system tries to help eliminate. By upgrade payroll system, the payroll process will be digitalized so it will make the payroll process is easier and faster. Some of the systems are cloud-based so the HR staff and those who need to access payroll data can access it any time anywhere.

There are some signs that it’s time for a company to upgrade payroll system. What are those signs?

1. Business Expansion

When it’s time for your company to expand the business, it’s time to upgrade payroll system too. With cloud-based software, the HR department can easily access their employees’ data from anywhere. Even if companies have branches all over the nation. The data will be stored in an online cloud system so the HR department can manage the data from the main office.

When the business expands and opens new branches, it is almost impossible to manage the payroll in the old manual way. This because the employees will be in different places and the HR usually in the main office. If there is some problem with the payroll, the HR staff doesn’t need to go to the branch office to resolve it. One of the reasons why company needs to upgrade payroll system.

Also, with business expansion, usually, employee headcount also will increase. So, instead of using the time to manually calculating employees’ payroll every month, the HR department can use their time to plan a more strategic approach such as plans for employee retention.

2. Employee headcount

If the company still has a small number of employees, it might be easier to manage payroll manually. But what if the size of employee increase? Let’s say every month, the HR department has to calculate the payroll of 50 employees with only 3 staff. How much time and resources needed to do this effectively? This might take days to finish the payroll calculation. Some might want to hire more HR staff, but this doesn’t solve the problem because it actually costs more.

Manual calculating is also prone to human error or miscalculation. By upgrade the payroll system, this error is minimized and the time spent on calculating payroll will not as much as manual calculation.

Also, with the increasing amount of employee headcount, the payroll data can be more varied and complex. There might be some change too on the data. Such as an employee that gets their permanent resident needs to get their data updated because this will affecting CPF calculations.

3. Comply Government Regulations

Government regulations are dynamic and always change over time. If this still handled manually by HR staff, they might get “jet lag” from all the changes in regulations. It can create confusion on what’s new and what’s old regulation and how to implement it in the company. To minimize these risks, a software system is always updated with the latest government regulations. This way, the company doesn’t need to worry about the change in government regulations and where should they implement the new regulations.

Manual payroll processing might take too much time and prone to human error. As said before, payroll calculation is not just calculating which employee needs to be paid this much. The company also has to comply with government regulations and these regulations can change.

If the company upgrade payroll system to a digital one, its HR department can focus on another thing such as how to develop the best training for the employees. If the employee headcount growing, this will be harder for HR staff to calculate their payroll, the payroll system will help this by automating the payroll process.

HRMLabs as Payroll Software

HRMLabs is centralized cloud-based payroll software. Not only we help the company to calculate its employees’ payroll automatically, but we also help them to comply with government regulations. We are a pre-approved solution by IMDA so local SMEs can enjoy funding support from PSG on our solutions.

We can help company to generate payslip, IR8A, CPF, and even taxes in one centralized platform. Our software is 100% cloud-based so you don’t have to worry about data loss or data theft. With cloud-based, you also can access the necessary data at any time from anywhere.

With a centralized cloud system, we reduce the time spent on processing payroll and automate process flow from attendance taking, take leave into account, then eventually generating payslip. So that you don’t have to adjust payment with attendance and leave by yourself or facing the hassle of generating payslips, but get the final amount by one button.

We provide mandatory itemized payslip with configurable payment items such as employee information to show and exemption (allowance, deduction, reimbursement)

You can differentiate who can access or see certain information. Such as who can see whose payslip, to ensure privacy and security of the information.

Let’s discuss how HRMLabs can help your company payroll issues by clicking this link.